How To Invest in Stocks For Teens (Full Beginners Guide)

Last updated: Jul 30, 2023

This video is a full beginners guide on how to invest in stocks for teenagers, covering topics such as the basics of the stock market, stock types and terminology, how to get started, accessing free stocks, brokerage walkthrough and tutorial, researching stocks, building a stock portfolio, taxes, tips for successful investing, and beginner resources.

This video by Brian Jung was published on Jul 10, 2023.

Video length: 53:37.

This YouTube video is a full beginner's guide on how to invest in stocks for teenagers.

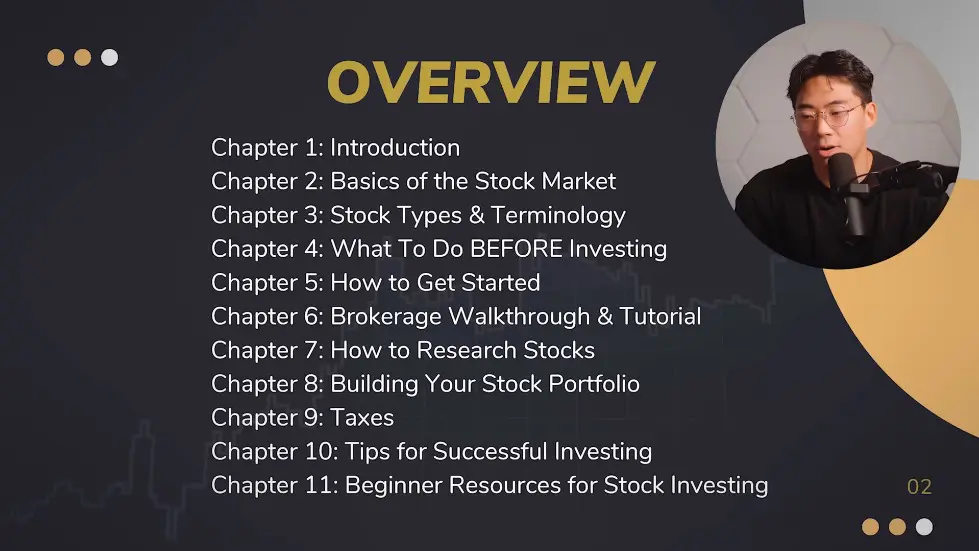

The video is divided into 11 chapters, covering topics such as the basics of the stock market, stock types and terminology, how to get started, accessing free stocks, brokerage walkthrough and tutorial, researching stocks, building a stock portfolio, understanding taxes, tips for successful investing, and recommended beginner resources. The presenter, Brian, shares his personal journey from being a troubled student to starting his own business and building a multi-million dollar company.

He aims to provide knowledge and guidance that schools may not teach and help teenagers achieve financial stability and success through investing.

- The video is a full beginners guide on how to invest in stocks for teenagers.

- The chapters cover topics such as the basics of the stock market, stock types and terminology, how to get started, accessing free stocks, brokerage walkthrough and tutorial, researching stocks, building a stock portfolio, taxes, tips for successful investing, and beginner resources.

- The video is relevant for teenagers and even younger individuals who want to invest in the stock market.

- The presenter introduces himself as Brian, a YouTuber who teaches personal finance and investing.

- The presenter shares his personal background, including his experience in school and getting kicked out for fighting.

- He talks about his decision to provide financial stability for himself and his parents.

- The presenter explains that the video aims to teach viewers what schools won't teach them and help them get rich through investing.

- The video is a comprehensive guide with 11 chapters covering various aspects of investing in stocks.

- Starting early allows you to take a long-term perspective and ride out market fluctuations.

- Investing has become more accessible and democratized with commission-free platforms.

How To Invest in Stocks For Teens (Full Beginners Guide) - YouTube

Introduction

- The video is a full beginners guide on how to invest in stocks for teenagers.

- The presenter gives an overview of the video's content, which includes 11 chapters.

- The chapters cover topics such as the basics of the stock market, stock types and terminology, how to get started, accessing free stocks, brokerage walkthrough and tutorial, researching stocks, building a stock portfolio, taxes, tips for successful investing, and beginner resources.

- The video is relevant for teenagers and even younger individuals who want to invest in the stock market.

- The presenter introduces himself as Brian, a YouTuber who teaches personal finance and investing.

Background and Personal Journey

- The presenter shares his personal background, including his experience in school and getting kicked out for fighting.

- He talks about his decision to provide financial stability for himself and his parents.

- He discusses his experience in community college and his realization that he didn't want to follow the traditional path of going to college and working a 9-to-5 job.

- The presenter mentions his various jobs, including working with his dad doing hardwood floors and working with kids who had autism.

- He talks about educating himself through podcasts and books, eventually starting his own business and building a multi-million dollar company.

Why the Video is Made

- The presenter explains that the video aims to teach viewers what schools won't teach them and help them get rich through investing.

- He emphasizes the importance of understanding stocks and the stock market.

- The presenter wants to ensure that viewers can make good investment decisions and avoid losing money.

- He shares his own experiences of both making and losing a significant amount of money in the stock market.

- The presenter wants to inspire viewers who come from non-wealthy backgrounds to believe that they can also achieve financial success.

How To Invest in Stocks For Teens (Full Beginners Guide) - YouTube

Course Overview

- The video is a comprehensive guide with 11 chapters covering various aspects of investing in stocks.

- Topics covered include the basics of the stock market, stock types and terminology, how to get started, accessing free stocks, brokerage walkthrough and tutorial, researching stocks, building a stock portfolio, taxes, tips for successful investing, and beginner resources.

- The presenter promises to provide valuable knowledge and a deep understanding of how to get started in investing.

- The video is designed to give viewers the best possible information and guidance.

- The presenter encourages viewers to believe that they can also achieve financial success and provide for their loved ones.

Advantages of Investing as a Teenager

- Starting early allows you to take a long-term perspective and ride out market fluctuations.

- You can invest in riskier and higher growth assets to generate higher returns.

- You can benefit from compound interest, which can lead to even higher returns over time.

- Investing can replace the need for a traditional job and potentially become a full-time profession.

- Investing at a young age sets you up for long-term success and expertise in the industry.

- Investing is a great hedge against inflation and helps preserve your purchasing power.

- It helps build financial discipline and develop good financial habits.

Why Now is the Best Time to Get Started

- Starting early as a teenager allows you to reach your financial goals quicker.

- There is an abundance of free knowledge and resources available on investing.

- It has never been cheaper to get started with investing.

- Some brokerages offer free stocks worth thousands of dollars.

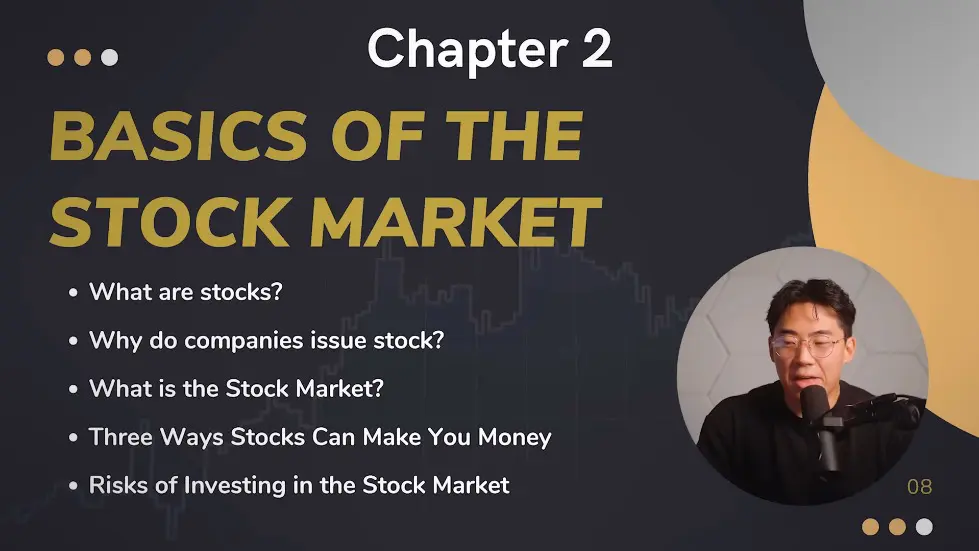

Basics of the Stock Market

- Investing has become more accessible and democratized with commission-free platforms.

- Inflation is decreasing the value of cash, making investing more important.

- The amount of money you can make in the stock market depends on factors like how long you invest, how much you invest, and what you invest in.

- Warren Buffett has made billions of dollars investing in stocks.

- By investing $300 per month in the S&P 500 from age 18 to retirement, you could make over $3.6 million.

Stock Market Basics

- When you buy a stock, you become a shareholder and own a small piece of the company.

- The value of your ownership stake can go up or down based on how well the company is doing.

- Investing in stocks can be a way to grow your wealth over time.

- However, it also comes with risks, as the performance of the company can affect the value of the stock.

- Companies issue stocks to raise money for their business by selling ownership to investors.

Three Ways to Make Money with Stocks

- Capital appreciation: The value of your stocks increases over time.

- Dividends: Some companies distribute a portion of their profits to shareholders.

- Stock splits: When a company's stock price increases, they may split the stock, giving shareholders more shares.

- By combining these three methods, you can potentially earn significant returns on your investments.

- However, it's important to research and choose stocks wisely to maximize your chances of success.

Risks of Investing in Stocks

- Stock prices can be volatile and fluctuate based on market conditions.

- There is always a risk of losing money when investing in stocks.

- It's important to diversify your portfolio to minimize risk.

- Researching and understanding the company's financials and future prospects is crucial.

- Investing in stocks requires patience and a long-term perspective.

Basics of the Stock Market

- The stock market is a place where people can buy and sell tiny pieces of ownership in bigger companies.

- When you invest in a company, you are giving them money in exchange for a tiny piece of ownership in that company.

- People can buy and sell these ownership pieces on the stock market exchange.

- There are three ways to make money from stocks: capital appreciation, capital depreciation, and dividend payments.

- Market volatility and economic uncertainty are risks of investing in the stock market.

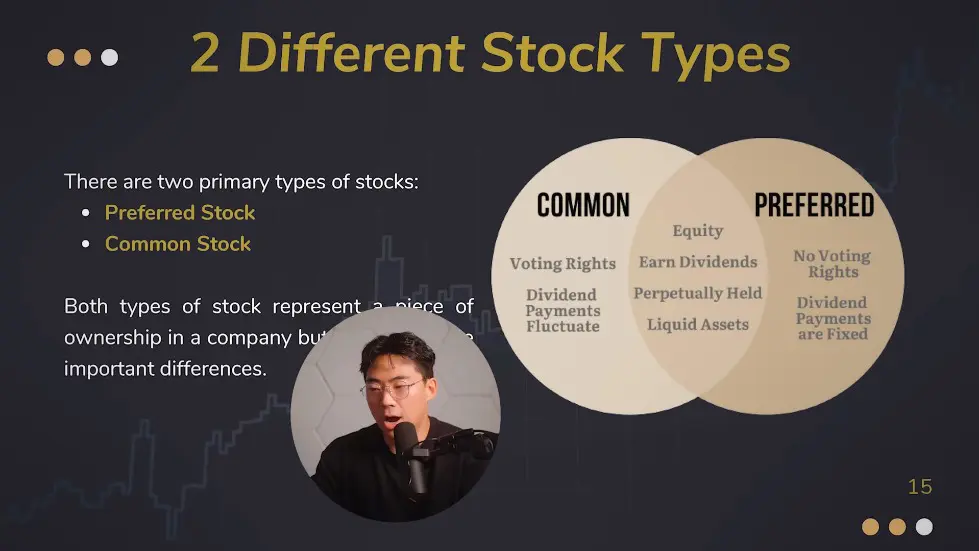

Stock Types and Terminology

- When a company issues stock, they give you two types: common stock and preferred stock.

- Common stock gives you voting rights and the potential for dividends.

- Preferred stock gives you a higher claim on the company's assets and earnings, but usually no voting rights.

- Market value is the price at which a stock is currently trading.

- Shorting a stock means betting that its price will go down.

Getting Started and Accessing Free Stocks

- To get started, you need to open a brokerage account.

- There are many online brokerage platforms to choose from.

- Some brokerages offer free stocks as a sign-up bonus.

- You can also earn free stocks by referring friends to the brokerage.

- Research different brokerages to find one that suits your needs.

Researching Stocks and Building a Stock Portfolio

- Researching stocks involves analyzing a company's financials, industry trends, and competitive advantages.

- Look for companies with strong fundamentals and a track record of growth.

- Diversify your portfolio by investing in different industries and asset classes.

- Consider your risk tolerance and investment goals when building your portfolio.

- Regularly review and adjust your portfolio to ensure it aligns with your investment strategy.

Risks of Investing in Stocks

- There are general risks associated with investing in stocks, such as market volatility and economic downturns.

- There are also company-specific risks, such as financial difficulties or bad press, that can affect the value of a stock.

- Timing risk is another factor, as poor market timing can lead to short-term losses.

- You only lose money in the stock market if you sell a stock for a loss.

Types of Stocks

- Preferred stocks have priority over a company's income and are paid dividends before common shareholders, but they have no voting rights.

- Common stocks, which make up the majority of stocks, have voting rights and fluctuating dividend payments.

- Stocks can be categorized based on company size (small cap, mid cap, large cap), sector and industry, and investment style and strategy (growth, dividend, value).

- Growth stocks have high potential for above-average growth, while value stocks are considered undervalued.

- Categorizing stocks helps understand their characteristics and risks and can aid in diversification.

Important Stock Market Key Terms

- There are numerous stock market key terms, but the video focuses on the most important ones.

- A full PDF rundown of stock market key terms is available for further reference.

- Understanding key terms like Blue Chip stocks can enhance investing knowledge.

- Signing up for the stock newsletter provides access to the PDF and additional resources.

- Knowing key terms is crucial for successful investing.

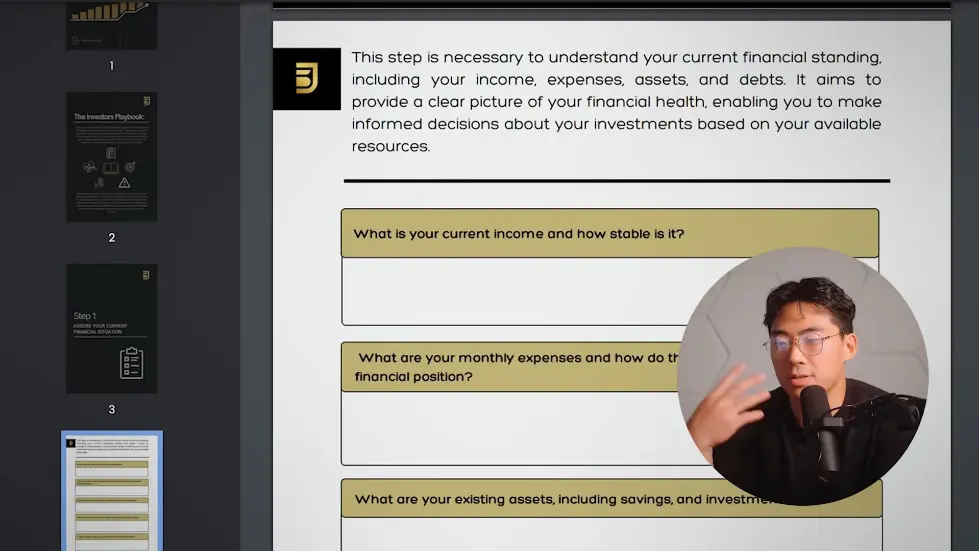

Investing Prerequisites

- Before starting to invest, it is important to eliminate debt and have a rainy day fund.

- These prerequisites may vary depending on individual circumstances and living situations.

- Setting financial goals and determining investment strategies aligns with personal aspirations.

- Considering factors like time horizon and desired earnings helps shape investment decisions.

- Having a clear understanding of personal financial situation is crucial before entering the stock market.

Section 1: Building a Financial Foundation

- Eliminate debt, including credit card debt, before investing.

- Have a rainy day fund with at least $1,000 in savings.

- Fill out a monthly budget and assess your risk tolerance.

- Consider your current income, stability, expenses, and existing assets.

- Use a 14-page PDF guide to help you assess your financial situation.

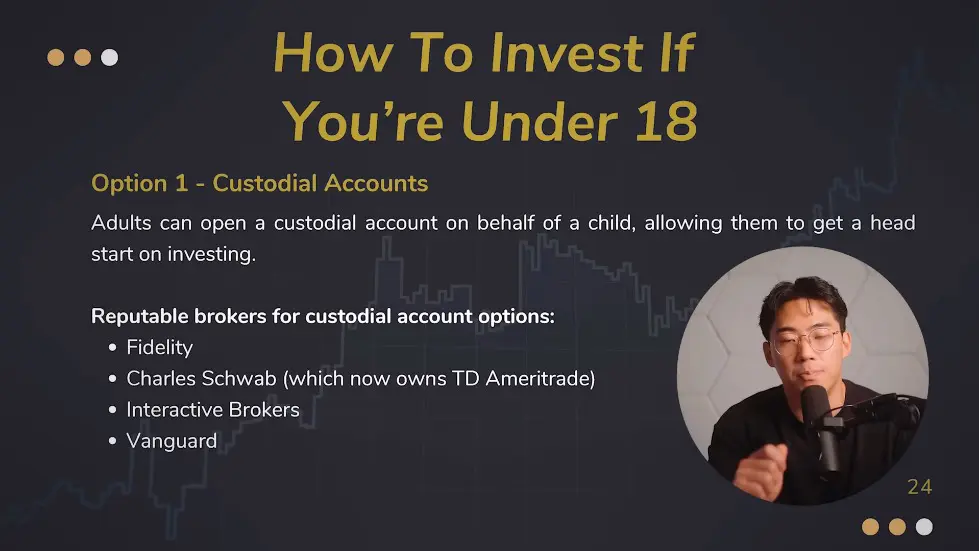

Section 2: How to Get Started

- If you're under 18, have an adult open a custodial account for you.

- Adults can open custodial accounts at Fidelity, Charles Schwab, TD Ameritrade, or Vanguard.

- If you can't find an adult to open a custodial account, consider paper trading.

- Paper trading allows you to practice investing without risking real money.

- Consider using TradingView for paper trading, as it has a user-friendly interface.

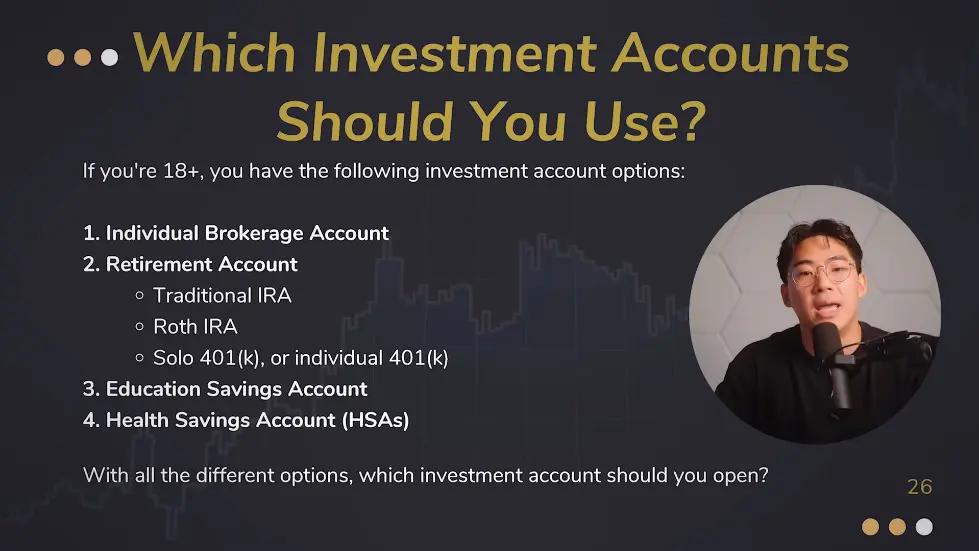

Section 3: Investment Accounts for Adults

- For individuals over 18, consider opening an individual brokerage account.

- Retirement accounts include traditional IRAs, Roth IRAs, solo 401ks, and individual 401ks.

- Education savings accounts and health savings accounts are also options.

- A mix of a Roth IRA and an individual brokerage account is recommended.

- This allows for both long-term retirement savings and short-term investment flexibility.

Section 4: Choosing a Brokerage

- Consider using commission-free brokerages like Robinhood or Webull.

- Research and compare different brokerages to find one that suits your needs.

- Look for brokerages with user-friendly interfaces and educational resources.

- Consider the fees, account minimums, and available investment options.

- Take advantage of any promotions or free stock offers when opening an account.

Choosing a Brokerage

- Individual brokerage accounts are a good starting point for teens.

- Popular brokerages for beginners include MooMoo, Weeble, and Robinhood.

- MooMoo and Weeble offer more free stocks than Robinhood.

- MooMoo currently offers up to 16 free stocks a month.

- Weeble offers about 12 free stocks, which can be worth more than MooMoo's offer.

Getting Started with a Brokerage

- Download the brokerage app and fill out the details.

- Connect your bank account and deposit any amount instantly.

- Complete the "know your consumer" (KYC) process.

- Buy and sell stocks and redeem free stocks.

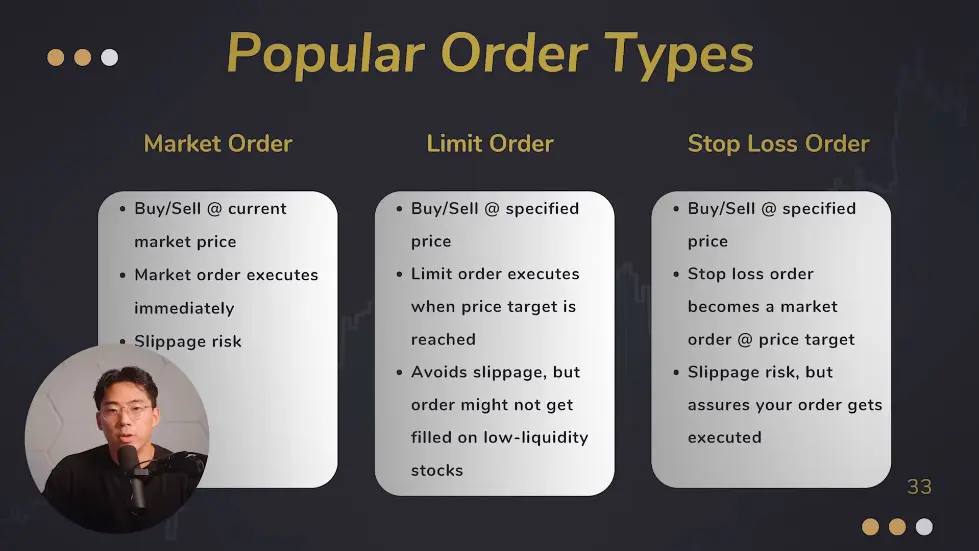

- Understand the three popular order types: market order, limit order, and stop loss order.

Order Types

- Market order: Buy or sell a stock at the current market price.

- Limit order: Specify a specific price to buy or sell a stock.

- Stop loss order: Buy or sell a stock once its price reaches a specified trigger level.

- Market orders may have slippage, especially for low-cap or penny stocks.

- Limit orders are recommended to avoid slippage.

Stop Loss Orders

- Stop loss orders are used to limit potential losses or initiate a trade at a specific price point.

- They become market orders once the stop price is reached.

- They help minimize losses for investors.

- Stop loss orders differ from limit orders in that they become market orders.

- They are useful for managing risk and protecting investments.

Understanding Stock Analysis

- There are two primary ways to analyze stocks: fundamental analysis and technical analysis.

- Fundamental analysis evaluates a stock by measuring the intrinsic value of a company.

- Technical analysis looks at statistical trends such as movements in stock price and volume.

- Fundamental analysis includes factors like balance sheets, income statements, and cash flow statements.

- Technical analysis involves looking at trend lines, candlestick fundamentals, moving averages, and trading volumes.

Pros and Cons of Fundamental Analysis

- Pros of fundamental analysis include a deep understanding of a company's performance and a long-term investment perspective.

- Cons of fundamental analysis include time-intensive research, limited short-term predictability, and subjectivity.

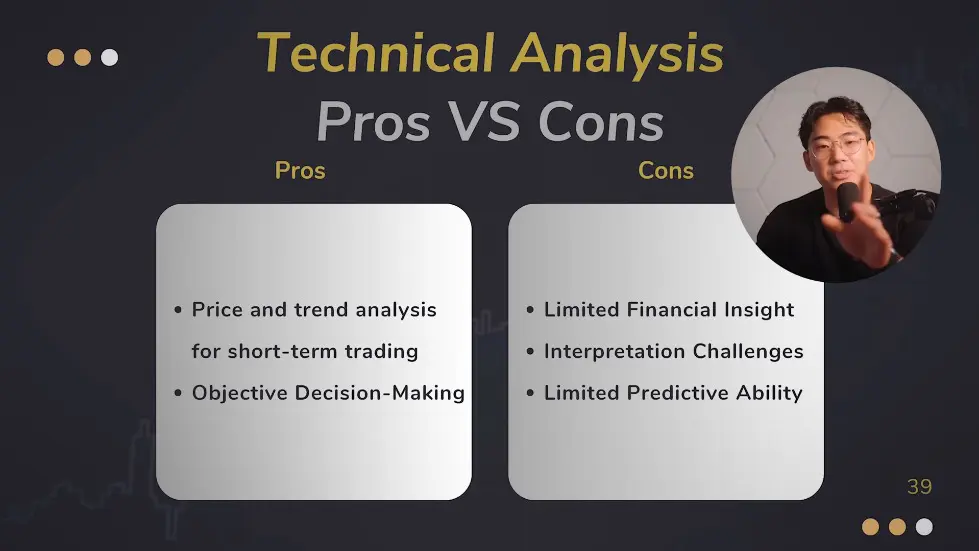

Pros and Cons of Technical Analysis

- Pros of technical analysis include short-term trading advantages and suitability for day traders.

- Cons of technical analysis include limited financial insight, interpretation challenges, and limited predictive ability.

Using Both Fundamental and Technical Analysis

- Using a mix of both fundamental and technical analysis can provide a comprehensive research approach.

- Consider your investing style and risk tolerance when deciding which analysis method to use.

- Combining fundamental analysis with trends and technical indicators can help identify buying opportunities.

- Having a full understanding of stocks and different types of analysis is crucial for successful investing.

- Use a stock screener to filter and screen stocks based on specific criteria to narrow down your investment options.

Screening for Stocks

- Parameters to screen for include market cap, specific industry or sector, valuation ratios, and dividend yields.

- Technical indicators can also be used to identify potential buying opportunities.

Staying Informed on Market News

- Consistently stay informed on market news, trends, and company developments.

- Watching news channels or using online resources can help you stay updated.

- Being aware of market trends can help you identify potential investment opportunities.

Building a Stock Portfolio

- Consider your risk tolerance, investment goals, and financial situation when building your portfolio.

- Low-risk investments include bonds, index funds, and blue-chip stocks.

- High-risk investments include small-cap stocks, emerging market stocks, and sector-specific stocks.

- Consider diversifying your portfolio by investing in ETFs or creating your own basket of funds.

- Dollar cost averaging is a recommended strategy, which involves consistently investing a fixed amount of money into chosen investments regardless of their current price.

Benefits of Dollar Cost Averaging

- Dollar cost averaging helps mitigate the impact of market volatility and reduces the risk of investing a large amount of money at a market peak.

- It enables a disciplined and systematic investment approach over time.

- It is particularly valuable for long-term investments.

- By consistently investing over time, you benefit from the principle of time in the market rather than trying to time the market.

- You can customize your dollar cost averaging strategy based on your investment goals and budget.

Section 1: Basics of the stock market and stock types

- Investing in index funds is the easiest way to go if you don't want to do research.

- Investing in the S&P 500 gives you exposure to the top stocks in the market.

- Spreading out your risk by investing in different stocks mitigates risk.

- Understanding custodial accounts and the kitty tax.

- Kitty tax applies if you're under 18 or a full-time student aged 18 to 24.

Section 2: Getting started and accessing free stocks

- Choose a brokerage platform to start investing.

- Consider using platforms that offer free stocks as a sign-up bonus.

- Walkthrough and tutorial on how to set up a brokerage account.

- Understanding the process of buying and selling stocks.

- Exploring different investment strategies and goals.

Section 3: Researching stocks and building a stock portfolio

- Learn how to research and analyze stocks before investing.

- Understand key financial metrics and ratios to evaluate stocks.

- Diversify your portfolio by investing in different sectors and industries.

- Consider long-term investing for better chances of success.

- Reinvesting gains instead of cashing out for exponential growth.

Section 4: Taxes and tips for successful investing

- Understand the tax implications of investing, including capital gains tax.

- Consider investing in tax-advantaged accounts like Roth IRA or 401k.

- Utilize tax loss harvesting to offset gains with losses.

- Invest for the long term and avoid following blind trades.

- Create a plan for each trade, including profit targets and stop losses.

Section 1: Tips for Successful Investing

- Trade like a robot and keep emotions out of investment decisions.

- Don't get married to a stock; be willing to sell when necessary.

- Don't overthink investing; stick with a strategy, start small, and be consistent.

- Never invest more than 20% of your checking account.

- If you don't have a lot of money, consider fractional shares or starting a side hustle to make more money.

Section 2: Beginner Resources for Stock Investing

- Stock newsletter with access to PDFs and questionnaires.

- Investopedia and Invis as online resources for learning definitions and fundamental analysis.

- Trading view as a web-based platform for advanced yet easy-to-use tools.

- Recommended books on investing: "Intelligent Investor," "Rich Dad Poor Dad," "Psychology of Money," and "The Wealthy Gardener."

- Additional helpful links and access to the PowerPoint presentation in the video description.

Watch the video on YouTube:

How To Invest in Stocks For Teens (Full Beginners Guide) - YouTube

Related summaries of videos:

- How to Invest in Crypto in 2023 - Full Beginner’s Guide

- 4 Best Investing Apps for Beginners To Make Money Today

- Unboxing My NEW Credit Card | $30K Credit Limit

- Chase Sapphire Preferred vs. Reserve - Which is Really Better?

- Top 7 Premium Tier Credit Cards 2024

- How The Next Crypto Bull Run Will Make Us Millions

- Amex Gold Card - 9 Secret Benefits & Tips

- Why Chase Freedom Flex is the Best Starter Credit Card

- Amex Platinum vs. Chase Sapphire Reserve | Which is Better?

- How To Invest in Crypto For Teens